The use of earnouts in M&A has increased over the last decade and likely will continue to do so over 2023 as parties need to resolve differences relating to valuation.

There are several metrics commonly used in structuring an earnout. The choice of metric is driven by the buyer but is often strongly influenced by emphasis placed by the seller on its KPIs during the pitch process. So be careful what you wish for because you will be held to it in an earnout.

Earnouts work best when sellers roll over some meaningful equity and stay involved in the business, or management does not fully cash out at closing. Sellers will be more reluctant to agree to an earnout when their ability to influence future performance is limited.

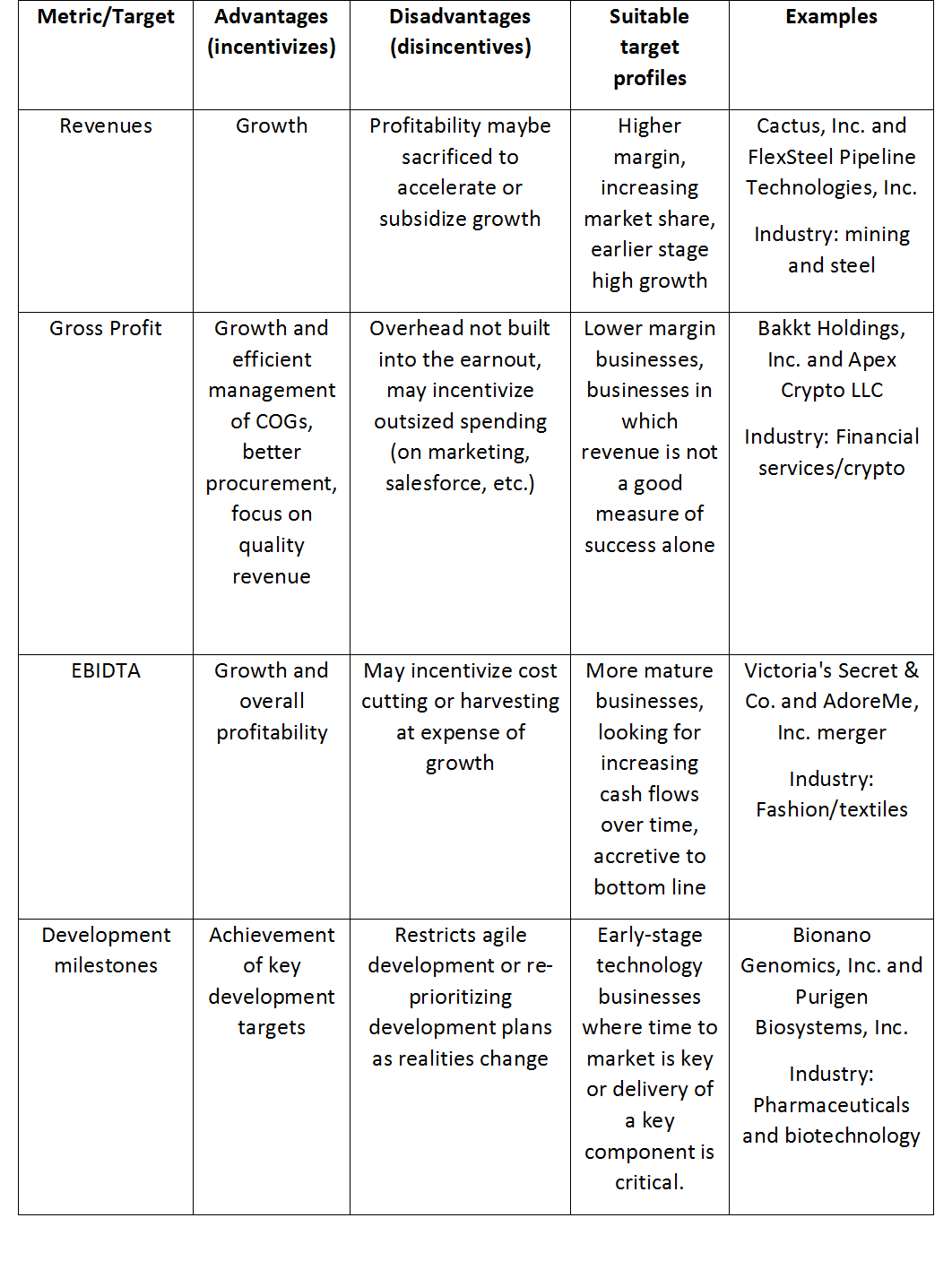

One truism is that behavior will follow incentive. The table below provides a brief summary of some of the considerations involved in selecting an appropriate earnout metric. Each company comes with its own set of variables so there is no one size fits all. We have also included for reference some recent deals that reflect these different approaches.

The metrics in the above table are not exhaustive. Parties can often be very creative in customizing earnout targets to the specifics of the target business. For example, subscriber numbers, transaction volumes, and FDA approvals maybe used as a condition for the seller to receive deferred compensation.

Feel free to reach out if you would like to discuss structuring earnouts or any aspect of your M&A plans. jamesr@apm.law